Current Liabilities Balance Sheet Obligations Due Within 1 Year

Accrued expenses use theaccrual method of accounting, meaning expenses are recognized when they’re incurred, not when they’re paid. Current liabilities can be compared with non-current, or long-term liabilities. This is possible if the borrower proclaims that the violation would be made good within the grace period mentioned in the loan agreement. These notes do not specifically mention the rate of interest on the face of note. This amount is greater than the cash received by him on the date of issue of such a note. Current liabilities, therefore, are shown at the amount of the future principal payment.

Ideally, suppliers would like shorter terms so that they’re paid sooner rather than later—helping their cash flow. Suppliers will go so far as to offer companies discounts for paying on time or early. For example, a supplier might offer terms of “3%, 30, net 31,” which means a company gets a 3% discount for paying 30 days or before and owes the full amount 31 days or later. Accounts payable, or “A/P,” are often some of the largest current liabilities that companies face.

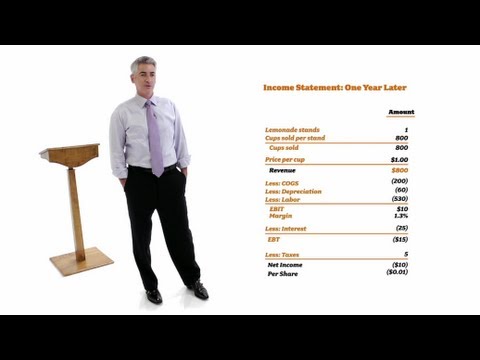

The company’s accountants record a $1 million debit entry to the audit expense account and a $1 million credit entry to the other current liabilities account. When a payment of $1 million is made, the company’s accountant makes a $1 million debit entry to the other current liabilities account and a $1 million credit to the cash account. Although the current and quick ratios show how well a company converts its current assets to pay current liabilities, it’s critical to compare the ratios to companies within the same industry. For example, a company might have 60-day terms for money owed to their supplier, which results in requiring their customers to pay within a 30-day term.

Relevance and Uses of Current Liabilities Formula

You can also install Vedantu’s app on your smartphone to take the learning with you everywhere. The obligations of paying pension benefits to employees take effect after a considerable time. The pension amount is accumulated till the point of retirement, the duration of which spans across years. Also, if cash is expected to be tight within the next year, the company might miss its dividend payment or at least not increase its dividend.

Tax liability, for example, can refer to the property taxes that a homeowner owes to the municipal government or the income tax he owes to the federal government. When a retailer collects sales tax from a customer, they have a sales tax liability on their books until they remit those funds to the county/city/state. Creditors are also known as Trade payables/Accounts Payables/Bills payable. They are your suppliers to whom the company owe money for purchasing the goods or services on credit terms.

The cluster of liabilities comprising current liabilities is closely watched, for a business must have sufficient liquidity to ensure that they can be paid off when due. All other liabilities are reported as long-term liabilities, which are presented in a grouping lower down in the balance sheet, below current liabilities. Current liabilities offer a critical view of a company’s liquidity and whether an organisation’s management is efficient enough to settle those obligations with their current assets.

This offer cannot be combined with any other QuickBooks Online promotion or offers. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

A company will also incur a tax payable within any operating year that it makes a profit and, thus, owes a portion of this profit to the government. Fixed AssetsFixed assets are assets that are held for the long term and are not expected to be converted into cash in a short period of time. Plant and machinery, land and buildings, furniture, computers, copyright, and vehicles are all examples. Non-current liabilities are used to assess a venture’s solvency and to determine whether or not a firm is effectively leveraging it. To know more about non-current liabilities, you can read articles related to this topic available on our online platform.

A contingent liability is an obligation that might have to be paid in the future, but there are still unresolved matters that make it only a possibility and not a certainty. Lawsuits and the threat of lawsuits are the most common contingent liabilities, but unused gift cards, product warranties, and recalls also fit into this category. Companies of all sizes finance part of their ongoing long-term operations by issuing bonds that are essentially loans from each party that purchases the bonds. This line item is in constant flux as bonds are issued, mature, or called back by the issuer. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years.

What is Meant by Current Liabilities?

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Non-current liabilities are due in more than one year and most often include debt repayments and deferred payments. AT&T clearly defines its bank debt that is maturing in less than one year under current liabilities. For a company this size, this is often used as operating capital for day-to-day operations rather than funding larger items, which would be better suited using long-term debt.

It may arise from bond payable or bank loans which may be recorded in the balance sheet in the form of amortized cost. These ratios help to understand whether a company has enough cash and other current assets to pay off its current liabilities. Current liabilities are debts a company owes that must be paid within one year.

- Current assets are short-term assets either in form of cash or a cash equivalent which can be liquidated within 12 months or within an accounting period.

- The amount of a bond obligation that will not be paid within the following year is referred to as a noncurrent debt.

- Investors assess non-current liabilities to understand whether the company may be employing excessive leverage.

- An enterprise may prefer selecting a short term note repayment when it feels that the rate of interest may decrease in the upcoming years.

- Banks, for example, want to know before extending credit whether a company is collecting—or getting paid—for its accounts receivable in a timely manner.

On the other hand, there are many service and retail businesses having more than two operating cycles within a year. A firm may receive cash in advance of performing some service or providing some goods. Since the firm is obligated to perform the service or provide the goods, this advance payment is a liability. As noted, however, the current portion, if any, of these long-term liabilities is classified as current liabilities. Long-term liabilities are those liabilities that will not be satisfied within one year or the operating cycle, if longer than one year. Included in this category are Mortgages Payable, Bonds Payable, and Lease Obligations.

Your form has been submitted

Hence, even if an operating cycle extends beyond one year, it shall be considered as the time frame based on which liabilities of a company are categorised. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. The interest payable refers to the interest that you must pay to lenders.

When you borrow money, the lenders will charge interest because you are not paying them back instantly. It also includes the interest that has been charged on the loans you took for your business. Interest payable is a liability towards interest expenses that has been incurred but yet to be paid as on the date of balance sheet.

A Bank overdraft facility is given by the banks where the companies or other borrowers are given the benefit of drawing the amount over their bank account balances available. For example, the balance in the bank account of ABCCompany is $1,000 but the bank allows the company to withdraw $1,200 from their bank account. For instance, a company may take out debt in order to expand and grow its business.

This is taxes withheld from employee pay, or matching taxes, or additional taxes related to employee compensation. These are the trade payables due to suppliers, usually as evidenced by supplier invoices. Notes payable is a kind of written promissory note prepared when a lender lends some money to the borrower. Through that promissory note, the borrower promises the lender to repay the money and the predetermined interest until the specified time.

Accruals are revenues earned or expenses incurred which impact a company’s net income, although cash has not yet exchanged hands. For example, if a company has more expenses than revenues for the past three years, it may signal weak financial stability because it has been losing money for those years. Liabilities are a vital aspect of a company because they are used to finance operations and pay for large expansions. For example, in most cases, if a wine supplier sells a case of wine to a restaurant, it does not demand payment when it delivers the goods.

Other Definitions of Liability

Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Companies having high creditworthiness may avail such loans at a lower rate of interest. This loan obligation will fall under non-current liabilities in the balance sheet of a company. Loans that a firm will have to pay over a longer duration are considered to be long-term loans.

It’s important for a company to carefully manage its non-current liabilities because they can significantly impact the company’s financial health over the long term. Suppose a company is unable to make payments on its non-current liabilities. In that case, it may face financial difficulties, which can harm its reputation and ability to secure financing in the future. Short-term debt is typically the total of debt payments owed within the next year.

Broadly, liabilities are of two types based on the time frame in which they are supposed to be written off from a company’s books –current liabilitiesand non-current liabilities. AP typically carries the largest balances, as they encompass the day-to-day operations. AP can include services,raw materials, office supplies, or any other categories of products and services where no promissory note is issued. Since most companies do not pay for goods and services as they are acquired, AP is equivalent to a stack of bills waiting to be paid. A liability is something a person or company owes, usually a sum of money.