LIFO Reserve Formula, Calculator and Example LIFO vs FIFO

In simple words, this method assumes that the most recent goods added to an inventory are sold first. You can try our most efficient and reliable lifo calculator to manage the inventory goods that were added to your inventory concerning lifo method. When you sell the newer, more expensive items first, the financial impact is different, which you can see in our calculations of FIFO & LIFO later in this post. For example, the seafood company, mentioned earlier, would use their oldest inventory first (or first in) in selling and shipping their products. Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company’s process of using the oldest inventory first in selling their goods. A company applying LIFO will face the problem of not being able to sell the oldest inventory from the stock, hence will also create a problem of not showing current market trends.

Since the economy has some level of inflation in most years, prices increase from one year to the next. So, which inventory figure a company starts with when valuing its inventory really does matter. And companies are required by law to state which accounting method they used in their published financials.

What is the FIFO method of food storage?

The best POS systems will include inventory tracking and inventory valuation features, making it easy for business owners and managers to choose between LIFO and FIFO and use their chosen method. Ng offered another example, revisiting the Candle Corporation and its batch-purchase numbers and prices. The goal of the FIFO inventory management method is to reduce inventory waste by selling older products first. For example, a grocery store purchases milk regularly to stock its shelves. As customers purchase milk, stockers push the oldest product to the front and add newer milk behind those cartons.

In this blog, we will discuss inventory valuation and accounting principles. We will cover why it is so important to value your inventory, different methods for inventory valuation, and how you should choose your inventory valuation method based on your business. FIFO stands for First In, First Out, which means the goods that are unsold are the ones that were most recently added to the inventory. Conversely, LIFO is Last In, First Out, which means goods most recently added to the inventory are sold first so the unsold goods are ones that were added to the inventory the earliest.

What is LIFO, and how does it work?

A company can choose from various methods to determine its inventory costs suggested by GAAP. GAAP refers to a standard set of accounting principles that have been issued by the Financial Accounting Standards Board (FASB). GAAP suggests that How to calculate fifo and lifo businesses use one of two different inventory accounting methods – first-in-first-out (FIFO) or last-in-first-out (LIFO). In this situation, using the FIFO accounting method would yield higher profits and a higher taxable income statement.

FIFO is also the option you want to choose if you wish to avoid having your books placed under scrutiny by the IRS (tax authorities), or if you are running a business outside of the US. However, it does make more sense for some businesses (a great example is the auto dealership industry). For this reason, the IRS does allow the use of the LIFO method as long as you file an application called Form 970.

What is FIFO and LIFO?

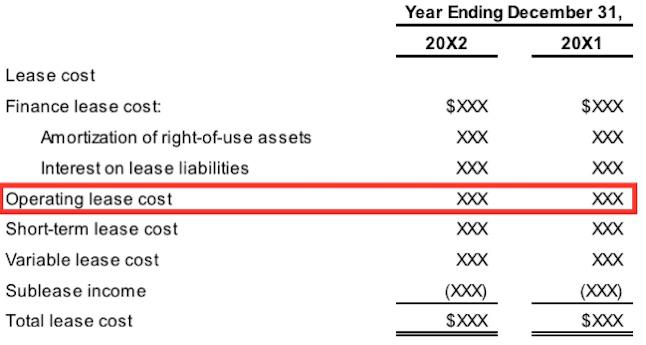

Some companies still use LIFO within the United States for inventory management but translate it to FIFO for tax reporting. Only a few large companies within the United States can still use LIFO for tax reporting. Because of the current discrepancy, however, U.S.-based companies that use LIFO must convert their statements to FIFO in their financial statement footnotes. This difference is known as the “LIFO reserve.” It’s calculated between the cost of goods sold under LIFO and FIFO.

Par Pacific Holdings Reports Strong Second Quarter 2023 Results – GlobeNewswire

Par Pacific Holdings Reports Strong Second Quarter 2023 Results.

Posted: Mon, 07 Aug 2023 20:15:00 GMT [source]

Using FIFO simplifies the accounting process because the oldest items in inventory are assumed to be sold first. When Sterling uses FIFO, all of the $50 units are sold first, followed by the items at $54. Do you routinely analyze your companies, but don’t look at how they account for their inventory? For many companies, inventory represents a large, if not the largest, portion of their assets.

Fifo Lifo Calculator

However, the reduced profit or earnings means the company would benefit from a lower tax liability. The inventory valuation method you choose can affect amount of taxes you pay the government. LIFO and FIFO are the most popular methods used in the United States, but which one is preferable depends on your individual business circumstances. This method assigns the same cost to each item, by dividing the total cost of goods by the total number of items available for sale. This method is also known as the weighted average and is calculated over a specific time period.

In this case, the store sells 100 of the $50 units and 20 of the $54 units, and the cost of goods sold totals $6,080. Let’s assume that a sporting goods store begins the month of April with 50 baseball gloves in inventory and purchases an additional 200 gloves. Goods available for sale totals 250 gloves, and the gloves are either sold (added to cost of goods sold) or remain in ending inventory. If the retailer sells 120 gloves in April, ending inventory is (250 goods available for sale – 120 cost of goods sold), or 130 gloves.

Keeping the MAC auto calculation separate means that each location or warehouse you’ve marked down in Katana can maintain independent accounting numbers. This means that the same material or product can have a different moving average cost for each location. If we assume all other factors stay the same, your cost of goods sold would increase because the most recent, and therefore most expensive, items are included in the calculation. Under the moving average method, COGS and ending inventory value are calculated using the average inventory value per unit, taking all unit amounts and their prices into account. We also offer Develop API to enable a custom-built inventory management solution that ties into your accounting platform, to keep financial statements up-to-date, even when order volumes are skyrocketing. Using specific inventory tracing, a business will note and record the value of every item in their inventory.

- The main advantage of an average cost is that it provides a more accurate portrayal of your current inventory costs than either FIFO or LIFO.

- FIFO is an inventory valuation method for tax liability purposes, assuming that the first products acquired were the ones included in the cost of goods sold.

- For instance, LIFO valuation method can understate a firm’s earnings for the purposes of keeping taxable income low.

You should also know that Generally Accepted Accounting Principles (GAAP) allow businesses to use FIFO or LIFO methods. However, International Financial Reporting Standards (IFRS) permits firms to use FIFO, but not LIFO. Check with your CPA to determine which regulations apply to your business. In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age. No, the LIFO inventory method is not permitted under International Financial Reporting Standards (IFRS).

The lower the cost of inventory, the higher the profit and the tax rate. In accrual accounting, a transaction is recorded when it is earned, which is triggered by generating an invoice or receiving a bill. This is why it is essential to track your inventory along every phase of the business cycle. According to the Internal Revenue Service (IRS) if your business is holding inventory, then you are required to use the accrual method of accounting. The FIFO method and LIFO method are the most popular for inventory management.

To visualize how LIFO works, think of one of those huge salt piles that cities and towns keep to salt icy roads. When the trucks need to be filled, does the town take the salt from the top or bottom of the pile? When calculating costs, we use the cost of the newest (last-in) products first. We can say with certainty that the higher the cost of inventory, the lower the profit and the tax rate.

Germany Crypto Tax Guide in 2023 – Nomad Capitalist

Germany Crypto Tax Guide in 2023.

Posted: Tue, 23 May 2023 10:59:21 GMT [source]

Simple to use, whether a business or purchasing or producing goods, the end net income is a balance between FIFO and LIFO. It is a method of inventory management and valuation in which goods produced or acquired most recently are recorded as sold first. In other words, goods that were just received are accounted for ahead of stored backstock of the same item. The cost of the newest products is the first to be accounted for as the cost of goods sold (COGS), whereas the lower price of older goods are counted in inventory. Depending on how you value your inventory or which method you use, you can arrive at different figures for the same events over a period of time.